36+ mortgage how many years tax returns

Percent of income to taxes. Ad Mortgage loans without tax returns or paystubs for self-employed borrowers.

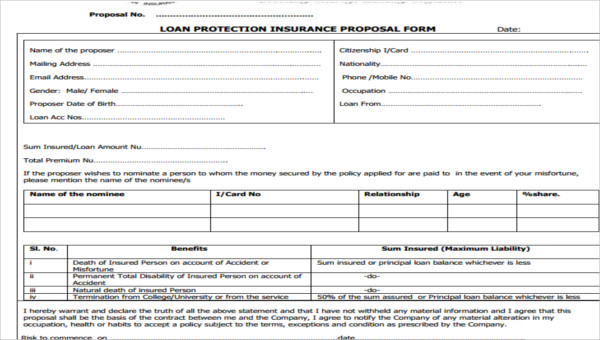

Free 11 Loan Proposal Forms In Pdf Ms Word

Home loan solution for self-employed borrowers using bank statements.

/cdn.vox-cdn.com/uploads/chorus_asset/file/6510321/56043648.jpg)

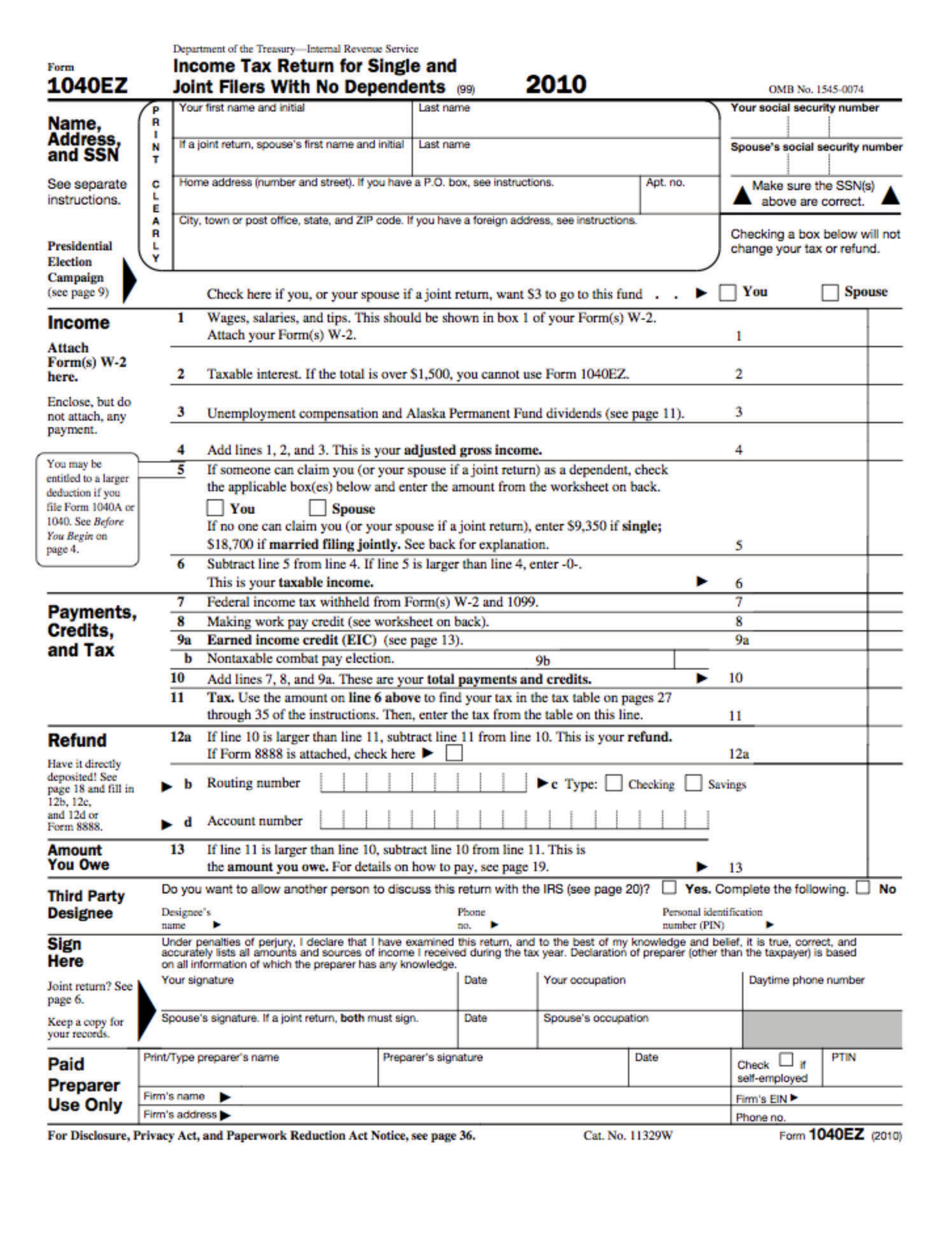

. Our income tax calculator calculates your federal state and local. Web For mortgages closed on or before December 15 2017 joint filers can deduct mortgage interest on the first 1 million of debt. Web The IRS recommends keeping returns and other tax documents for three yearsor two years from when you paid the tax whichever is later.

As well as copies of the borrowers signed federal income tax return. Its widely believed that you must have 2 years of tax returns in order to get a mortgage. Estimate your monthly mortgage payment.

Web Fortunately some borrowers can use just one year of tax returns to qualify for a mortgage. Lenders will check your tax returns from the last two to three years to verify the income you reported and the deductions you claimed. Keep records for 6 years if you do not report income.

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Lenders use your tax returns to confirm information provided in your mortgage. Get an idea of your estimated payments or loan possibilities.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. While this is certainly. Web The seven federal income tax brackets for 2022 are 10 12 22 24 32 35 and 37.

Web Income tax returns. Heres what you should know. The IRS has a.

Web Amended returns must be filed by paper for the following reasons. Web Property Tax. Web Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction.

But there are special rules to be aware of. Web 15-year mortgage rates. Web Can You Get A Mortgage With Only 1 Tax Return.

Your bracket depends on your taxable income and filing status. Fannie Mae requires that a borrowers DTI cant exceed 36. Web They want your total monthly debt obligations -- a figure that can include everything from your student-loan and auto-loan payments to your new estimated mortgage payment.

Web How you file your taxes has no real impact on your ability to qualify for a mortgage. Total Estimated Tax Burden. Ad See how much house you can afford.

Try our mortgage calculator. Ad Mortgage loans without tax returns or paystubs for self-employed borrowers. For loans closed on December.

Ad Use AARPs Mortgage Tax Calculator to See How Mortgage Payments Could Help Reduce Taxes. Any amended Form 1040 and 1040-SR returns older than three years or Form 1040-NR and. Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount.

Home loan solution for self-employed borrowers using bank statements.

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World

Can You Get A Mortgage With Just 1 Year Of Tax Returns

Homes Land Of The Smokies Vol 36 Issue 11 By Homes Land Of Tennessee Issuu

00w8kvsnu49g5m

How Much House Can You Afford The 28 36 Rule Will Help You Decide

Free Gst Filing Accounting Software Eztax In Books

Income Taxes

The 28 36 Rule How To Figure Out How Much House You Can Afford

Inequalities And Environmental Changes In The Mekong Region By Agence Francaise De Developpement Issuu

What To Do If You Need Last Year S Income Tax Returns To Get A Mortgage Sonoma County Mortgages

How Much House Can You Afford The 28 36 Rule Will Help You Decide

Paying Off A Mortgage Early How To Do It And Pros Cons

Paying Off A Mortgage Early How To Do It And Pros Cons

The 28 36 Rule How To Figure Out How Much House You Can Afford

Banking And Loan Businesses For Sale Bizbuysell

Full Article Dynamics Of Adult Participation In Part Time Education And Training Results From The British Household Panel Survey

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages